Over the years we have received numerous questions from Financial Professionals and Advisers regarding how to potentially position the Flat Rock Global Funds in a client’s portfolio. There are no absolute right answers to this question, but let’s examine this issue through the lens of the questions that many advisors have asked us over time:

1. Based on their own individualized set of factors, circumstances, and risk tolerances, my client has determined that they would like to allocate to Alternative Investments (“Alts”). How can we begin to incorporate Alts in an investment portfolio?

This question begs another question; what is an Alt? Historically Alts or alternative investments were any investments that were not traditional liquid bonds and equities. These alternative investments typically came in limited partnership structures. These structures typically had investment drawdowns where your investment commitment was drawn down over several years and returned over time with a finite life. These alternative investments might include private equity, real estate, hedge funds, private credit, and more esoteric asset classes. Given the structure, Alts were completely illiquid and often viewed as a place to try to gain access to outsized returns in exchange for the absence of liquidity. Historically Alts have been viewed as higher return and higher risk investments that might be a somewhat limited portion of a client’s portfolio.

We don’t view either Flat Rock fund (the Flat Rock Core Income Fund (Ticker: “CORFX”) or the Flat Rock Opportunity Fund (Ticker: “FROPX”) as alternative investments. The first goal of both of these funds as written in our prospectuses is preservation of capital. These are not funds that are trying to “hit home runs.” Our goal is to preserve capital while generating an attractive dividend yield. It’s helpful for investors to understand the interval fund structure of these funds. You can invest any day using the simple tickers CORFX or FROPX. Independent third-party firms determine the daily valuation of the funds. The funds are available to all investors, not just qualified and accredited investors, making them useful as broad, portfolio allocation tools. There are no inefficient drawdown structures. However, it’s also important to note that liquidity is limited to redemptions once a quarter as we tender for up to 5% of the equity each quarter or 20% per year. This limited liquidity allows investors to tap into the illiquidity premium that we believe is available as we invest in less liquid private credit. While we hope that our investors position their Flat Rock investments as long-term investments, the quarterly liquidity is useful for portfolio rebalancing and the occasional investor incurring an unusual liquidity need. In our opinion, the interval fund structure does not work well for investments deemed tactical in nature, where the advisor is trying to time the market by investing in private credit with plans to pivot out of the investment at some later point.

The question remains, if the Flat Rock funds aren’t typical alternative investments, but rather what I would prefer to call simply “less liquid investments,” what is the right portfolio allocation? Perhaps the historical reason to limit the percentage of alternative investments is due to a combination of the complete illiquid nature of the investments combined with the perception of these investments as riskier. Interval funds, or “less liquid investments” like the Flat Rock funds can include investments within a wide risk band. However, interval funds do offer quarterly liquidity. Every advisor needs to do their own due diligence and risk assessment on a particular interval fund’s potential risks. But within the context of this risk assessment, the limiting factor for how much of a given client’s portfolio might be allocated to “less liquid investments” is ultimately the liquidity needs of the client. As a result, we are seeing some advisors tap into the potentially higher returns available in less liquid, lower volatility interval funds like the Flat Rock funds by using these funds as core positions in their client’s portfolios and not limiting these positions by old alternative investment portfolio allocation guidelines.

2. Why would an adviser allocate to the Flat Rock Core Income Fund (CORFX) in a client’s portfolio?

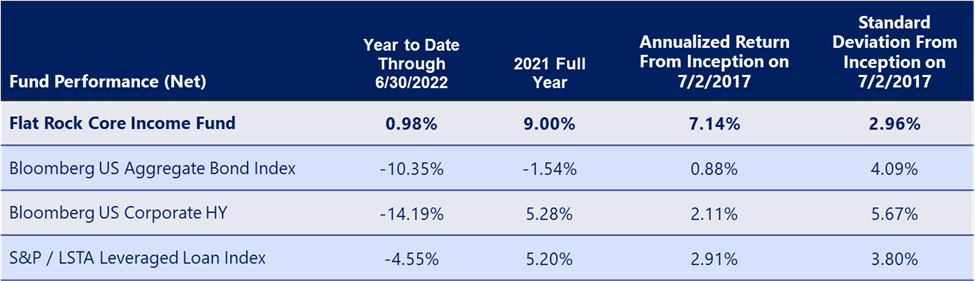

The Flat Rock Core Income Fund (“CORFX”) primarily invests in first lien floating rate loans to middle market companies owned by private equity firms. Flat Rock Core Income Fund’s objective is the preservation of capital while generating current income from its debt investments and seeking to maximize the portfolio’s total return. We believe that investors are paying a significant liquidity premium to invest in traditional fixed income that results in relatively low returns and potentially undue volatility and risk. Since June 30th, 2017, the inception of CORFX, the Bloomberg US Aggregate Bond Index (the “Agg”) has returned 0.88% with a standard deviation of 4.09%. 2022 year-to-date returns for the index are astonishingly a negative 10.35%. It seems you would be better off sitting in cash than investing in the Agg or a similar alternative. Conversely, CORFX during the same 5-year period has had average annual returns of 7.14% with a standard deviation of 2.96% and 2022 year-to-date performance (through June 30th) is up 0.98%. Some of the reasons for the differences in returns are the low duration, floating rate nature of the CORFX portfolio and as mentioned before, our view of the illiquidity premium available in private credit investments. To be fair, private credit investments are not risk-free investments, however, at CORFX we believe we try to minimize risk of loss by focusing on first lien, senior secured loans with low loan to values. Today, the average loan to value of the portfolio is 44%. As a result, we believe CORFX can be considered as a potential core position in a client’s portfolio.

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Flat Rock Core Income Fund’s performance, especially for very short periods of time, should not be the sole factor in making your investment decisions. For performance data current to the most recent month end, please call 307.500.5200. All historical performance prior to 11/23/2020 is of the Predecessor Fund. Flat Rock Capital Corp. Flat Rock Core Income Fund is a fund with the same assets, Advisor, and investment strategy as the Predecessor Fund.

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Flat Rock Core Income Fund’s performance, especially for very short periods of time, should not be the sole factor in making your investment decisions. For performance data current to the most recent month end, please call 307.500.5200. All historical performance prior to 11/23/2020 is of the Predecessor Fund. Flat Rock Capital Corp. Flat Rock Core Income Fund is a fund with the same assets, Advisor, and investment strategy as the Predecessor Fund.

3. Why would an adviser allocate to the Flat Rock Opportunity Fund (FROPX) in a client’s portfolio?

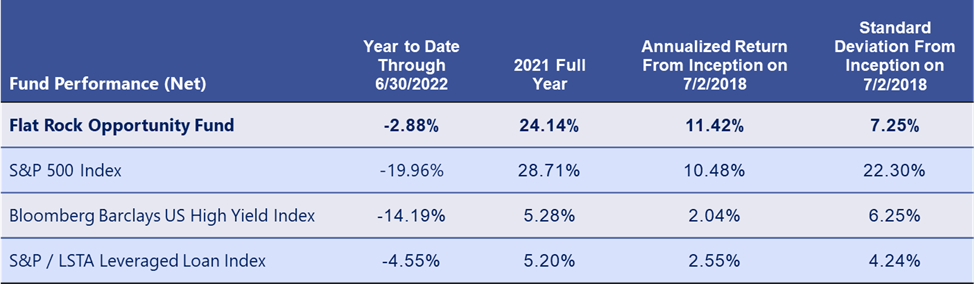

If the intent of the Core Income Fund (CORFX) is to be a potential core position in a fixed income portfolio, the intent of the Flat Rock Opportunity Fund (FROPX) is to offer investors the potential for higher returns, albeit in exchange for higher volatility. FROPX focuses on investing in highly diversified pools of private credit, but with leverage resulting in higher returns than CORFX. The result is average annual returns since inception on July 2, 2018 of 11.42% with an average standard deviation since inception of 7.25% and a current distribution rate of 13.3% as of June 30, 2022. FROPX might be viewed as an interesting alternative to high yield bonds. The Bloomberg Barclays US High Yield index has had average annual returns since the inception of FROPX of 2.04% and an average standard deviation over the same period of 6.25%. As a result, FROPX has significantly outperformed the return of high yield bonds with only slightly higher volatility.

However, we believe that a potentially more compelling way to use FROPX in portfolio allocation is as an equity alternative. Since the inception of FROPX, the S&P 500 has had average annual returns of 10.48% vs. 11.42% for FROPX, while the S&P 500’s standard deviation over that same period has averaged 22.30% vs. 7.25% for FROPX. The bottom line, since inception, FROPX has delivered equity-type returns at a fraction of the volatility of investing in equities. Based upon this data, an investment in FROPX as part of what would otherwise be an equity allocation can potentially deliver returns competitive with equities while reducing overall portfolio volatility. Allocating some of an investor’s traditional equity allocation to FROPX has another potential benefit; the current cashflow generated by FROPX can increase the cash generated by a portfolio and better position it to be patient during market downturns.

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Past Performance is no guarantee of future results. A Fund’s performance, especially for very short periods of time, should not be the sole factor in making your investment decisions.

The data provided above is based upon historical returns and does not guarantee future performance. Please feel free to reach out to us for more details on each of these funds. We look forward to continuing the dialogue.

Robert K. Grunewald

CEO and Founder

Disclosures

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds. This and other important information about the Funds are contained in the prospectus, which can be obtained by visiting flatrockglobal.com. The prospectus should be read carefully before investing.

Alps Distributors Inc. serves as our principal underwriter, within the meaning of the 1940 Act, and will act as the distributor of our shares on a best efforts’ basis, subject to various conditions.

FROPX Disclosures

The Fund’s investment objective is to generate current income and, as a secondary objective, long-term capital appreciation.

ALPS Distributors, Inc. serves as our principal underwriter, within the meaning of the Investment Company Act of 1940, as amended (the “1940 Act”), and will act as the distributor of our shares on a best efforts’ basis, subject to various conditions.

Diversification does not eliminate the risk of experiencing investment losses.

S&P 500 is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies by market value. S&P/LSTA U.S. Leveraged Loan Index is designed to reflect the performance of the largest facilities in the leveraged loan market. The Bloomberg Barclays US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below.

Interest Rate Risk: Rising interest rates may adversely affect the value of our portfolio investments which could have an adverse effect on our business, financial condition and results of operations.

Closed-End Management Company Risk: Regulations governing our operation as a registered closed-end management investment company affect our ability to raise additional capital and the way in which we do so. As a registered closed-end management investment company, the necessity of raising additional capital may expose us to risks, including the typical risks associated with leverage.

Repurchase Risk: The timing of our repurchase offers pursuant to our Repurchase Program may be at a time that is disadvantageous to our shareholders.

This communication shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state.

Market Risk: Changes in laws or regulations governing our operations may adversely affect our business or cause us to alter our business strategy. Global markets could enter a period of severe disruption and instability due to catastrophic events, such as terrorist attacks, acts of war, natural disasters, and outbreaks of epidemic, pandemic or contagious diseases, which could negatively impact the value of our investments and, in turn, harm our operating results.

Non-Diversified Risk: We may be more susceptible than a diversified fund to being adversely affected by any single corporate, economic, political or regulatory occurrence.

The Fund is suitable for investors who can bear the risks associated with the Fund’s limited liquidity and should be viewed as a long-term investment.

Our shares have no history of public trading, nor is it intended that our shares will be listed on a national securities exchange at this time, if ever.

No secondary market is expected to develop for our shares; liquidity for our shares will be provided only through quarterly repurchase offers for no less than 5% of and no more than 25% of our shares at net asset value, and there is no guarantee that an investor will be able to sell all the shares that the investor desires to sell in the repurchase offer.

Investing in our shares may be speculative and involves a high degree of risk, including the risks associated with leverage.

Investing in the Fund involves risks, including the risk that shareholder may lose part of or all of their investment.

We intend to invest primarily in the equity and, to a lesser extent, in the junior debt tranches of Collateralized Loan Obligations (“CLOs”) that own a pool of senior secured loans. Our investments in the equity and junior debt tranches of CLOs are exposed to leveraged credit risk. Investments in the lowest tranches bear the highest level of risk.

We may pay distributions in significant part from sources that may not be available in the future and that are unrelated to our performance, such as a returns of capital or borrowing. The amount of distributions that we may pay, if any, is uncertain.

CORFX Disclosures

▪ Flat Rock Core Income Fund (the “Fund”) is a continuously offered, non-diversified, closed-end management investment company that is operated as an interval fund.

▪ The Fund’s investment objective is the preservation of capital while generating current income from its debt investments and seeking to maximize the portfolio’s total return.

▪ ALPS serves as our principal underwriter, within the meaning of the 1940 Act, and will act as the distributor of our shares on a best efforts’ basis, subject to various conditions.

▪ Diversification does not eliminate the risk of experiencing investment losses.

▪ Interest Rate Risk: Rising interest rates may adversely affect the value of our portfolio investments which could have an adverse effect on our business, financial condition and results of operations.

▪ Closed-End Management Company Risk: Regulations governing our operation as a registered closed-end management investment company affect our ability to raise additional capital and the way in which we do so. As a registered closed-end management investment company, the necessity of raising additional capital may expose us to risks, including the typical risks associated with leverage.

▪ Repurchase Risk: The timing of our repurchase offers pursuant to our Repurchase Program may be at a time that is disadvantageous to our shareholders.

▪ Market Risk: Changes in laws or regulations governing our operations may adversely affect our business or cause us to alter our business strategy. We may be more susceptible than a diversified fund to being adversely affected by any single corporate, economic, political or regulatory occurrence. Regulations governing our operation as a registered closed-end management investment company affect our ability to raise additional capital and the way in which we do so.

▪ Investing in Senior Loans involves a number of significant risks. Below investment grade Senior Loans have historically experienced greater default rates than has been the case for investment grade securities.

▪ The Fund’s use of leverage creates the opportunity for increased returns in the Fund, but it also creates special risks. To the extent used, there is no assurance that the Fund’s leveraging strategies will be successful.

▪ All historical performance prior to 11/23/2020 is of the Predecessor Fund, Flat Rock Capital Corp. Flat Rock Core Income Fund is a newly launched fund with the same assets, Advisor, and investment strategy as the Predecessor Fund.

▪ Investing in the Fund’s shares involves risks, including the following:

- Shares of the Fund will not be listed on any securities exchange, which makes them inherently illiquid.

- There is no secondary market for the Fund’s shares, and it is not anticipated that a secondary market will develop. Thus, an investment in the Fund may not be suitable for investors who may need the money they invest in a specified timeframe.

- The shares of the Fund are not redeemable.

- Although the Fund will offer to repurchase at least 5% of outstanding shares on a quarterly basis in accordance with the Fund’s repurchase policy, the Fund will not be required to repurchase shares at a shareholder’s option nor will shares be exchangeable for units, interests or shares of any security.

- The Fund is not required to extend, and shareholders should not expect the Fund’s Board of Trustees to authorize, repurchase offers in excess of 5% of outstanding shares.

- Regardless of how the Fund performs, an investor may not be able to sell or otherwise liquidate his or her shares whenever such investor would prefer and, except to the extent permitted under the quarterly repurchase offer, will be unable to reduce his or her exposure on any market downturn.

- The Fund’s distributions may be funded from unlimited amounts of offering proceeds or borrowings, which may constitute a return of capital and reduce the amount of capital available to the Fund for investment. Any capital returned to shareholders through distributions will be distributed after payment of fees and expenses. The amounts and timing of distributions that the Fund may pay, if any, is uncertain.

- A return of capital to shareholders is a return of a portion of their original investment in the Fund, thereby reducing the tax basis of their investment. As a result of such reduction in tax basis, shareholders may be subject to tax in connection with the sale of Shares, even if such Shares are sold at a loss relative to the shareholder’s original investment.

- Shares are speculative and involve a high degree of risk, including the risk associated with below-investment grade securities and leverage.

DEFINITIONS

Duration can measure how long it takes, in years, for an investor to be repaid a bond’s price by the bond’s total cash flows. Duration can also measure the sensitivity of a bond’s or fixed income portfolio’s price to changes in interest rates.

Floating rate: A floating interest rate is one that changes periodically: the rate of interest moves up and down, or “floats,” reflecting economic or financial market conditions.

Standard deviation is a statistic that measures the dispersion of a dataset relative to its mean and is calculated as the square root of the variance. The standard deviation is calculated as the square root of variance by determining each data point’s deviation relative to the mean. If the data points are further from the mean, there is a higher deviation within the data set; thus, the more spread out the data, the higher the standard deviation.