On October 21, 2014, the final rules implementing the credit risk retention requirements of the Dodd-Frank Wall Street Reform and Consumer Protection Act were issued (the “U.S. Risk Retention Rule”). U.S. Risk Retention Rule required a CLO manager or affiliate to retain not less than 5% of the credit risk of the assets collateralizing the CLO. This could be achieved by the CLO manager owning approximately 50% of the CLO’s equity or a 5% vertical slice of all the CLO’s securities rated AAA down to equity. It was expected that CLO issuance would be negatively affected by these new requirements, but the opposite turned out to be true. CLO managers were successful in raising risk retention funds from their largest institutional investors, which was used to satisfy the new requirements.

The risk retention requirement ended on April 5, 2018, when it was successfully challenged in court. However, risk retention funds continue to exist. The business agreement between the CLO manager and the fund’s investors will likely continue until all the fund’s capital is called.

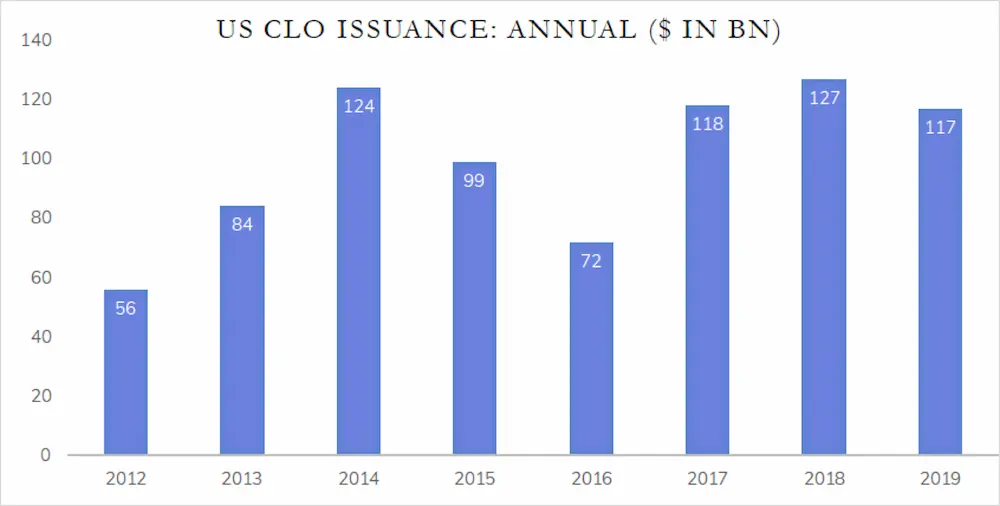

Source: Wells Fargo Research, January 2020

Risk retention funds enabled investors to participate pro-rata in a CLO manager’s next several years of issuance, with the largest managers issuing around four new CLOs a year. The risk retention fund’s investors were often given management fee rebates to entice them into the fund. However, management fee rebates have been available in the CLO market for a long time and participation in a risk retention fund isn’t required to benefit from them.

It is our belief that investors in these funds will be disappointed with their returns. It’s not because CLO equity doesn’t offer favorable risk-adjusted returns. It’s because the way the funds approach the market is fundamentally flawed.

To contrast, for an independent investor in CLO equity, the market is large at approximately $60 billion.1 There are over 100 managers issuing new CLOs and over 1,000 existing CLOs that could be invested in.1 Also, many independent investors buy the junior debt securities issued by CLOs when those securities offer high rates. An independent investor may invest in the primary market when CLOs are created or invest in a CLO that began its life in 2014. Most independent investors would want to be diversified by CLO manager and by the year of CLO issuance.

For the the risk retention funds, the investment universe is quite small – subsequent CLOs issued by a single manager. All other managers and the entire secondary market for CLO equity tranches are excluded. The pre-selected investment universe is less than 1% of the overall market! This is a recipe for underperformance.

In 2019, the debt costs for new CLOs were elevated. And the difference between the interest earned on the CLO loans and the interest paid on the CLO’s debt (the “arbitrage”) was at multi-year lows.1 At the same time, CLOs issued prior to 2019 were available in the secondary market that provided attractive risk-adjusted returns; that is where many independent CLO investors saw the best value. However, the risk retention funds continued to call capital and create new CLOs that arguably should not have been formed. Because the manager of a risk retention fund gets paid on assets under management, the incentive for the manager is to keep creating new CLOs.

CLO market participants like to break managers into different tiers. For example, a CLO manager that has a large investor following and good historical returns is considered a tier one manager, while a newer CLO manager might be a tier three or four manager. Since relative returns are constantly changing, managers’ categorizations are changing as well. An investor in a risk retention fund may find that its long-term commitment is to a CLO manager whose reputation isn’t what it once was. The independent CLO investor can quickly invest away from underperforming managers.

Risk retention fund investors may recognize these issues. At CLO conferences their strategy is discussed with incredulity on various panels. If these funds truly marked their holdings to market, fund investors would have put pressure on the managers to stop calling capital a long time ago.

While the CLO market can be difficult to understand for someone who doesn’t work in it daily, I often find it helpful to give analogies to the equity market. Imagine being approached for a new equity fund with this pitch: “Invest in our fund today, and we will do the next six IPOs underwritten by investment bank X. We don’t care about the company’s profitability, business model, management team, etc. We are doing the next six deals!” It’s hard for me to imagine this being a successful strategy, but that is the equity-equivalent to risk retention fund investing.

(1) The CLO Market Monthly Overview, February 2020, Wells Fargo Securities

For further information feel free to email info@flatrockglobal.com