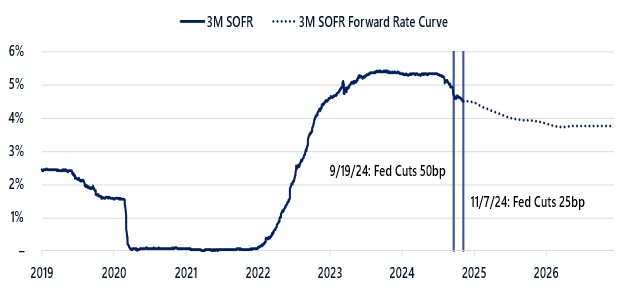

In September 2024, the Federal Reserve began its rate cutting cycle with a 50bps cut, followed by an additional 25bps cut in November. Market expectations, as reflected by US interest rate futures, anticipate further rate cuts in December and throughout 2025. The Secured Overnight Financing Rate (SOFR), which serves as the base rate for private credit and CLOs, closely tracks the Federal Funds Rate. The SOFR forward curve represents the market’s expectations for future rates, where interest rate professionals can swap floating rate payments to a fixed rate. Declining SOFR may have different effects on the asset classes important to me: private credit loans, CLO BBs, and CLO equity.

Note: All data as of 11/11/2024. Source: Bloomberg, Intex Solutions.

Private Credit Loans

Private credit loans typically reset their SOFR base rate every 30 to 90 days. As SOFR declines, lenders receive lower interest payments. However, even at 3.75% SOFR, the trough level on the SOFR curve, a middle market loan with a 5.0% spread would still yield 8.75%. I would consider this a compelling yield, as the loan is a senior and secured obligation of the borrower.

While lower loan income is negative for a lender, lower base rates may have some positive effects:

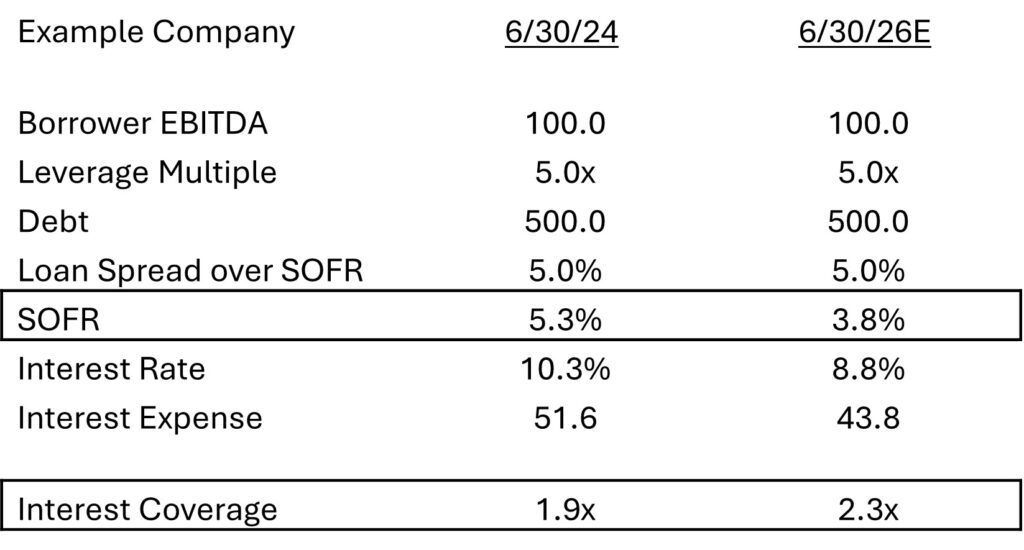

1.) Fewer Loan Defaults. Lower interest rates could decrease the frequency of loan defaults. To illustrate this, let’s examine a case study comparing interest burdens at two critical junctures: 6/30/2024, when SOFR was near its peak, and 6/30/2026, when SOFR is projected to hit a trough. In this example, the reduction in interest rates results in a nearly $8 million boost to the borrower’s cash flow. This improvement is reflected in the interest coverage ratio, a key metric measuring a borrower’s cash flow earnings (EBITDA) relative to annual interest expense, which increases from 1.9x to 2.3x. While most borrowers have managed to meet their interest payments even during periods of higher base rates, the projected decrease in rates could be crucial for others. For businesses operating with higher leverage, it could very well mean the difference between survival or default.

Source: Bloomberg, Flat Rock Global.

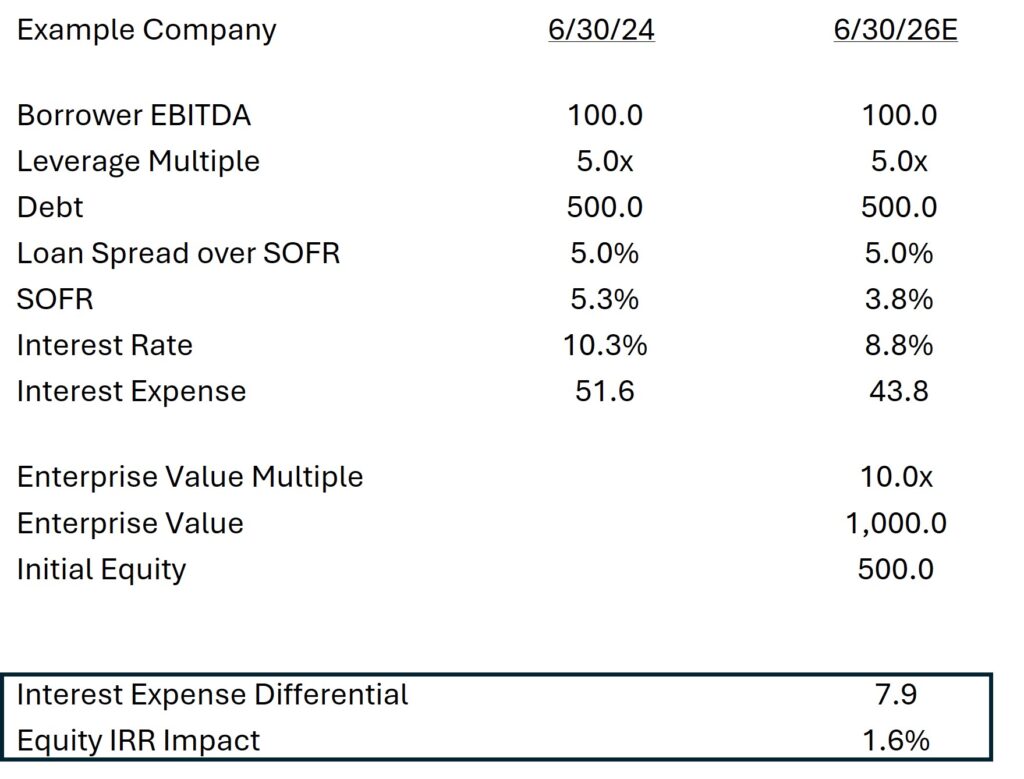

2.) Impact on Leveraged Buyout (LBO) Activity. The rise in interest rates in early 2022 had a significant effect on LBO activity. As loan financing became more expensive, LBO transactions saw a sharp decline. This slowdown resulted in a substantial accumulation of uninvested private equity capital, reaching approximately $2.1TL.1 If interest rates decrease as anticipated, I’d expect to see

a. Enhanced Private Equity Returns. The lower cost of borrowing could potentially boost private equity returns by approximately 1.6%.

b. Revival of LBO Activity. A more favorable interest rate environment may stimulate LBO transactions, creating additional loan opportunities for private credit investors.

Source: Bloomberg, Flat Rock Global.

CLO BBs

This yield appears attractive when considering the historical performance of CLO BBs. The default rate for these securities is 0.25% annually over a 30-year period.2

Lower interest rates would decrease borrowing costs for the underlying loan issuers, potentially improving their credit quality. This, in turn, might benefit the overall performance of CLOs. However, it’s important to recognize that actual defaults in CLO BBs are rare.

CLO Equity

CLO equity cash flows are primarily driven by the spread between the interest earned on the underlying loan portfolio and the financing cost of the CLO’s debt.

CLO equity is considered unlevered (however it does benefit from the overall leverage of the CLO), and lower base rates typically reduce CLO equity distributions. I believe it’s standard market practice to use the SOFR forward curve to project CLO equity cash flows. This method takes into account anticipated interest rate changes over time. Consequently, CLO equity pricing should already factor in an expectation of declining cash flows.

Targeted CLO equity returns in the mid-teens3 may appear particularly compelling when compared to other asset classes experiencing declining returns. Many investors view CLO equity returns as a premium over the yield offered by CLO BB tranches.

One notable feature of CLO equity is the common practice of incorporating a loan loss reserve into cash flow projections. Given that a typical CLO contains around 200 loans, some levels of defaults are to be expected. For instance, if an investor models a 2% default rate with a 70% recovery rate, any improvement in credit quality — potentially resulting from reduced interest rate burdens on borrowers — could positively impact projected returns.

Conclusion

1 Prequin, Private Equity in 2024, December 2023

2 S&P Global, Default, Transition, and Recovery: 2023 Annual Global Leveraged Loan CLO Default and Rating Transition Study

3 Flat Rock Global estimate using internal modeling assumptions