About CLOs

by Shiloh Bates

What is a CLO?

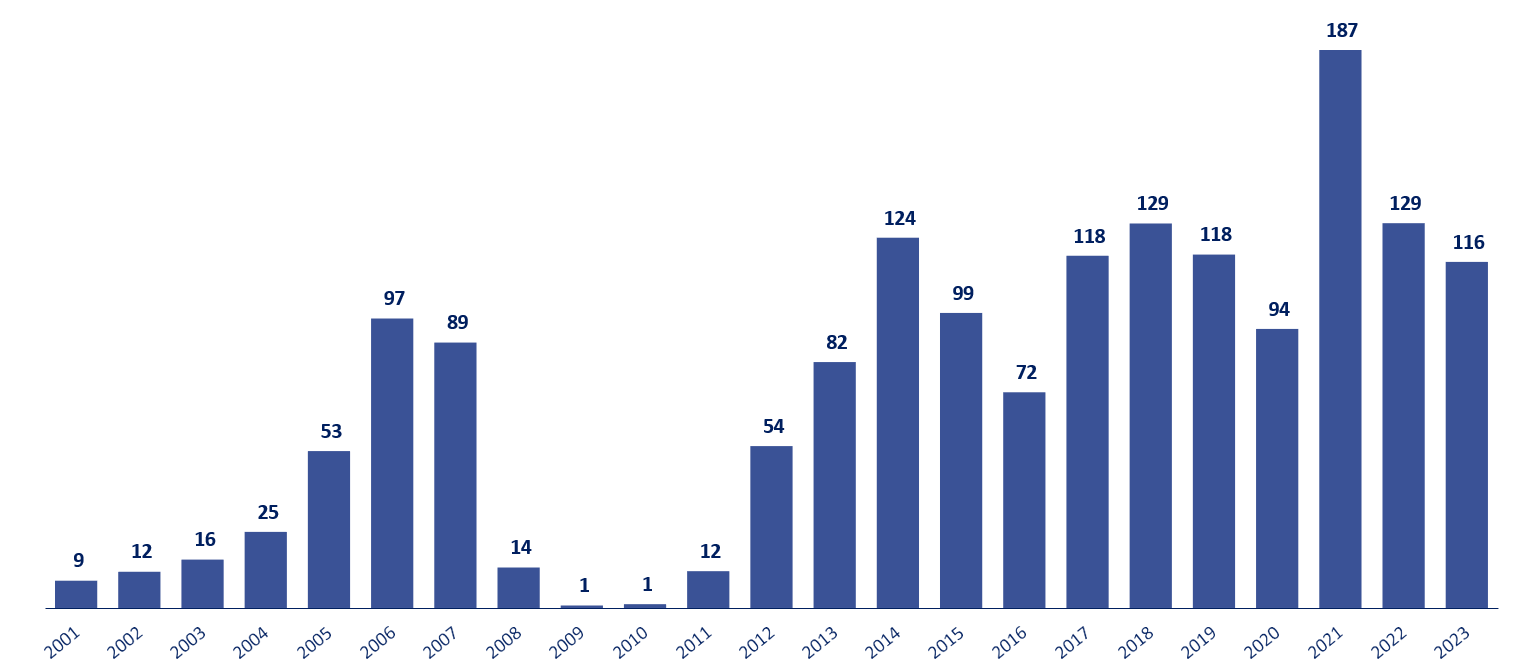

Annual CLO issuance has increased since the Global Financial Crisis (GFC). What’s driving this growth? The two primary drivers, in my opinion, are investors seeking exposure to actively managed portfolios of first lien loans combined with the performance of CLO securities over extended periods of time. As private equity AUM has grown, so, too, has CLO AUM.

Annual CLO Issuance ($bn)

How do CLOs work?

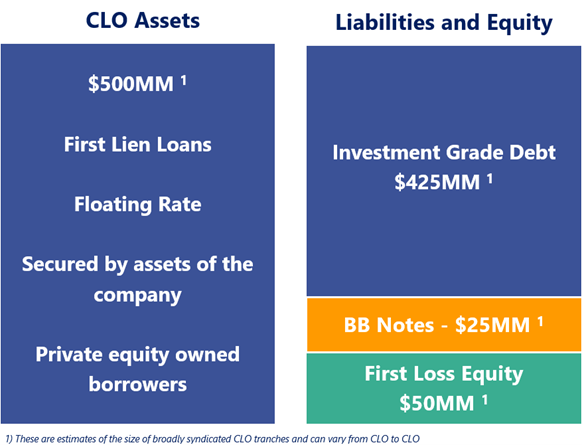

The CLO is partially financed with investment-grade debt, rated AAA to BBB, sold primarily to insurance companies and banks. At Flat Rock Global, our focus is CLO BB Notes and CLO Equity, which are the junior securities issued by the CLO.

Broadly Syndicated CLO Structure

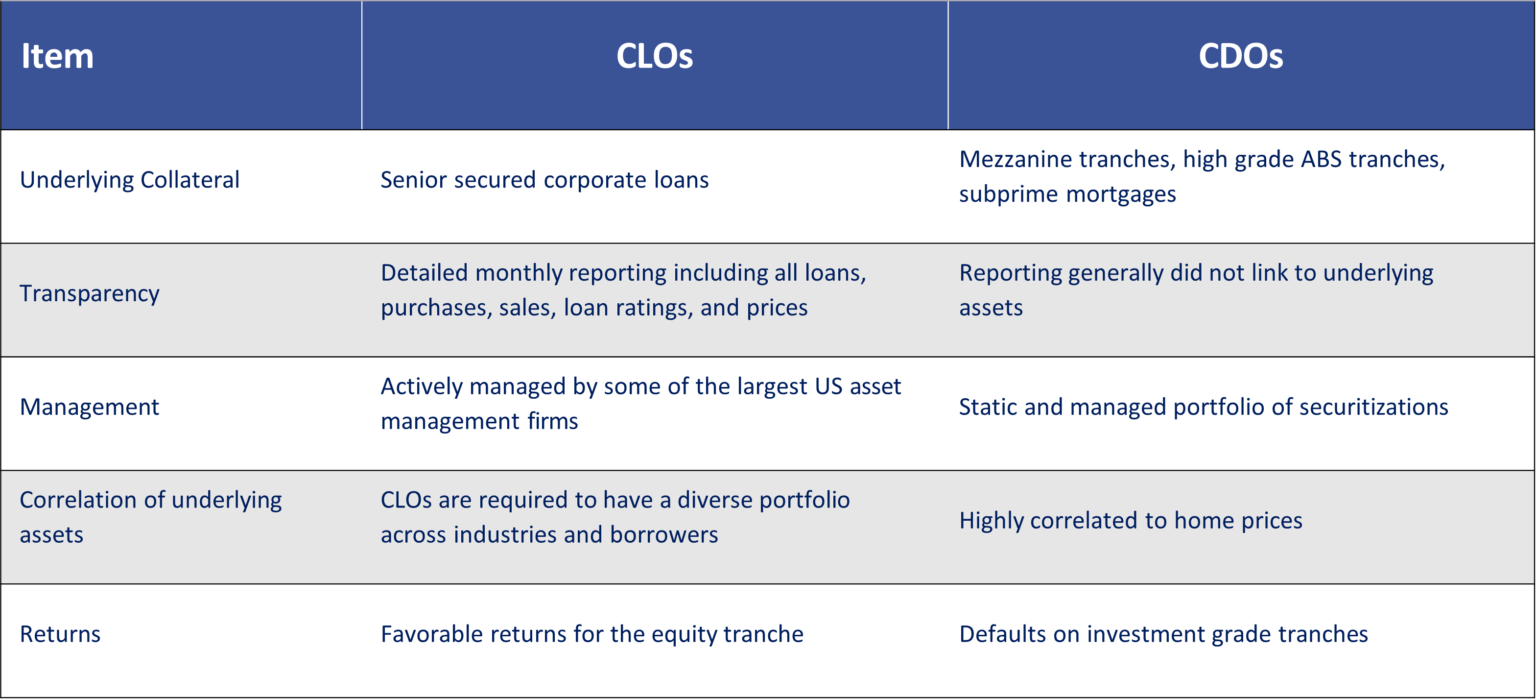

What's the difference between a CLO and CDO?

CLOs versus CDOs

Why CLO equity?

Collateralized Loan Obligations (CLO) equity offers the potential for mid-teen returns with low correlation to other asset classes like equities or high yield bonds. CLO equity allows investors to gain exposure to a highly diversified pool of leveraged loans using attractive built-in leverage that’s locked in for the life of the CLO. In contrast to other alternative investments, there is no “J Curve” in CLO equity. That’s because the CLOs pay quarterly distributions, and the initial distributions are usually higher than later ones. The higher initial cash flows mitigate the investment risk and make it harder – though not impossible – to have a negative lifetime Internal Rate of Return (IRR).

A potential downside to CLO equity is volatility, which can be equity-like in some market environments. Surprisingly to many, CLOs issued before the financial crisis did very well on a buy-and-hold basis. Returns were aided by what we refer to as the “self-healing mechanism” specific to CLOs.

CLOs have historically been an asset only available to large institutional investors. Given what we believe is the attractive risk/return characterization of CLOs and CLO equity, in particular, we believe retail investors will increasingly want access to the asset class.

Why middle market CLO BB rated notes?

CLO BB Notes provide exposure to middle market loans in a format where loan losses are generally absorbed by the CLO’s equity investor. CLO BB Notes have annual default rates of 0.22% since 1994, and offer yields above 12% today.