What is a CLO?

Shiloh Bates, the Chief Investment Officer of Flat Rock Global, explains what a CLO is, including how they are structured and function and why CLO BB notes and CLO equity in particular can offer potentially attractive returns with diversification benefits. Bates also highlights key differences between modern CLOs and historical CDOs.

How do CLOs work?

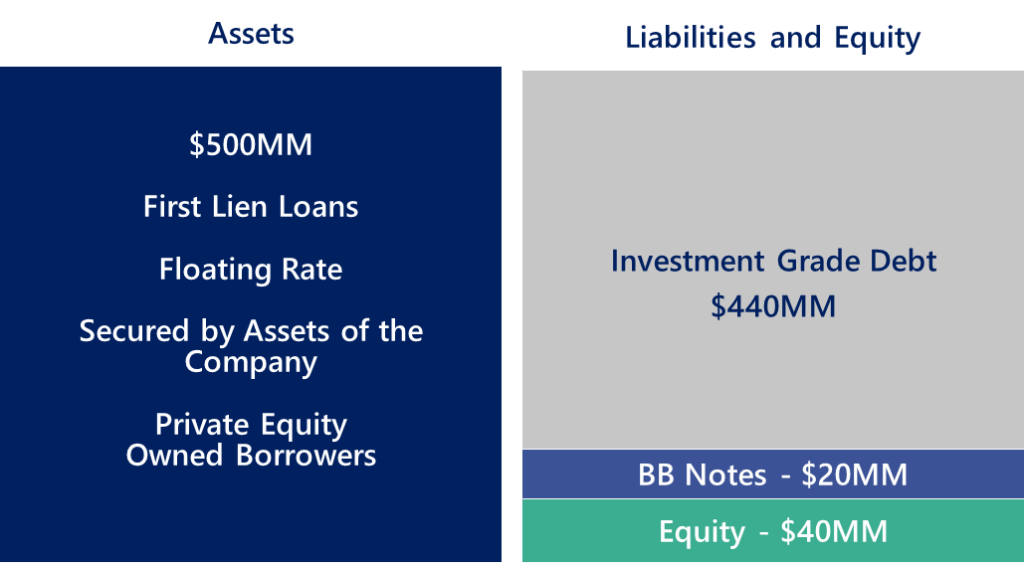

CLOs (Collateralized Loan Obligations) provide investors with exposure to diversified portfolios of actively managed senior secured loans, with built in long-term financing. Most of the CLO’s loans are created in Leveraged Buyouts (LBOs), where the secured loan makes up less than half of the enterprise value of the business. The leveraged loan is senior and secured, has a floating rate, and is rated below investment grade by rating agencies. The CLO’s financing is long-term and done on favorable terms.

The typical broadly syndicated CLO structure is about $500 million of assets. They’re generally secured by all the assets of the company. The CLO is partially financed with investment-grade debt, rated AAA to BBB, sold primarily to insurance companies and banks. At Flat Rock Global, our focus is CLO BB Notes and CLO Equity, which are the junior securities issued by the CLO.

Broadly Syndicated CLO Structure

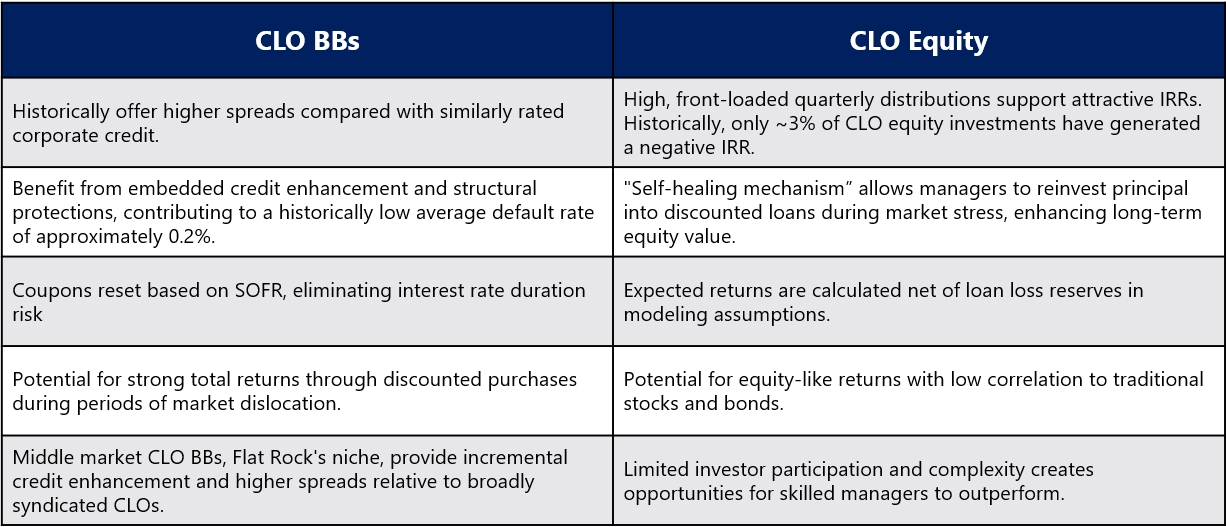

Why CLO BBs and Equity?